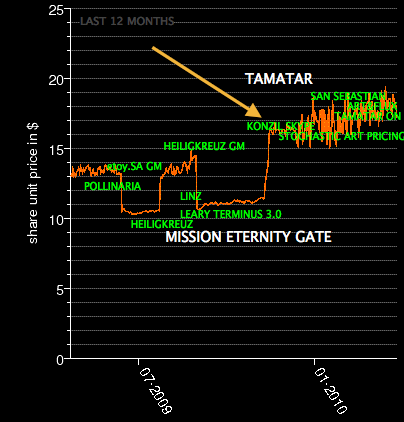

STOCHASTIC ART PRICING

etoy introduces automated stochastic art asset management

The price of the etoy.SHARE is negotiated among investors and based on supply and demand. As of January 2010, etoy uses automated stochastic art asset pricing to systematically manipulate returns, increase risk through above-normal variance, and boost investor excitement.

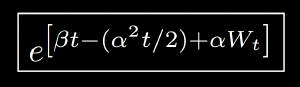

This step not only increases shareholder adrenaline levels but also helps the etoy.BOARD relax by spreading the risk and fun. The stochastic variance is implemented using a well known model widely used in both theoretical and applied mathematics: the Wiener process

agent.POL told the etoy.BOARD: "the interface for taking influence on the art roller coaster is ready"